Tally Company F11 Features

How Many Feature do you know?

Hello Readers,

It is general question

from all of Tally user about detail information of company features. Even

though we are using Tally.ERP9 since long but I can bet that none of us know

every feature of Tally in detail. Even Many of us using Tally like a common

software in our organization and belive that no one using even 50% feature

properly.

Today we will

discuss each F11 Feature available in Tally. Here we will only understand the

use and importance of feature on theoretical basis. (In case practical

information needed please drop your message in comment section I will explain

that feature in details)

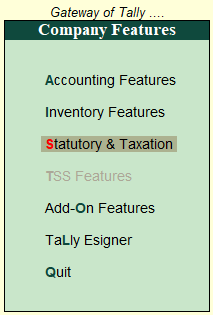

Tally Company

feature is broadly divided into 3 feature as below

1-

Accounting

Feature

2-

Inventory

Feature

3-

Statutory

and Taxation Feature

A-

Accounting

Feature :- Accounting feature is basically contain feature related to

accounting principal and option. Accounting feature have so many sub feature as

below

1)

Maintain

Accounts Only :- This feature

is basically for those who do not deals in stock or goods and want to maintain

books of accounts only for accounting and not for inventory. In case if you

enable this option Tally will not show and Inventory feature and you will not

be able to create any inventory master like stock item, stock group etc.

Basically this feature is applicable in case of service industries.

2)

Integrate

Account and Inventory :-

This is one of important feature to know. This feature is related to integrate

value of stock with your financial record. In simple word if have enable this

option then value of closing stock will be appeared in P&L and balance as

per Stock summary report. In case if you have disable the option the closing

stock value from stock summary will not be included in P&L and Balance

sheet. Generally this feature is being used by traders or dealers who are using

any other method or software for stock valuation and closing value arrived as

per their record they just feed to stock in hand ledger in Tally. (If you want

to see live then message on comment box)

3)

Use Income and

Expenses A/c instead of Profit and Loss A/c :-

This feature of Tally is being used by Non Profit

organization who need to report Income and expense account instead of profit

and loss. If you enable this feature then Profit and Loss report will be

replaced by Income and Expense Account and you will be able to see surplus and

deficit amount instead of Net profit and Net Loss

4)

Enable Multi

Currency:- This feature of Tally allow business unit to

raise or book any invoice of sales or purchase other then base currency.

Example Indian company can raise Invoice to any foreign company in US Dollar or

other currency needed. This feature help

you to get the value of foreign exhcnage gain or loss amount. This feature

generally famous among importer and exporter. (You can visit my page to know

more and step by step transaction www.gstintally.in or your can buy

E-Book where I have explained in detail step by step entry to use this feature

with 100% accuracy MRP Rs51)

5)

Maintain Bill

wise Details :- This

feature is most important one because it plays an important role to record each

sales and purchase with Invoice wise. This will help you to get proper bill

wise and age wise account receivable and payable report from Tally. Generally

this feature is applicable for Sundry Debtors and Sundry Creditors.

6)

Bill wise

Details For Non Trading Account also :- As point (v)

state the option of bill wise in debtors in creditor ledger but in case

if Tally user wants to use the same option for non trading ledger such Loans

and Advance given or borrowed and other ledger then this feature will help you

get bill wise detail for such ledgers too. It is important use this feature

wisely in case if you have enable bill wise option of for any expenses or

income ledger then your receivable and payable report will be disturbed.

7)

Activate

Interest Calculation :-

This feature is rarely used by us. This feature help you to calculate Interest

amount on specific rate of interest on overdue amount of payable and receivebla

as per your master configuration.

8)

Use Advanced

Parameter for Interest Calculation:- This feature is also related to Interest calculation

parameter and in case organization follow interest with different rate on each

transaction then this advance feature can be use.

COST PROFIT

CENTRE MANAGEMENT

9)

Maintain

Payroll:- We are very much

aware of meaning of payroll which refers to recording processing salary of

employees. Tally have given payroll feature where you can track record of payroll for every employee related to

their earning deduction and Income Tax Investment as well. (This feature can be

explained in detail if needed with examples)

10)

Maintain Cost

Centre :- Cost centre or

profit centre feature is important feature that can be used to get financial

P&L report as per project or cost centre wise. This feature is commonly

used for any project or any branch or any department as per need of business.

11)

Maintain more

then One Payroll or Cost Category :- This feature help you to create multiple cost

categories in organization as per layers and demand.

12)

Use Predefined

Cost Centre Allocation in Transaction :- Generally this feature help you to tag particular

entry under specific cost category. Normally while passing any entry cost

centre need to be selected after ledger selection but with this feature you can

tag entire entry under specific category or cost centre at one time. (Detail

info can be share if needed)

13)

Show Opening

Balance for revenue items in report:- Generally cost centre behave like P&L ledger

while reporting hence if you enable this

feature then you can view closing and opening balances of cost centres as well.

INVOICING

14)

Enable

Invoicing (Record Purchase Invoice):- Invoice (Sales or Purchase) can be recorded either in

Account Invoice mode (Inventory Mode) or Voucher mode but in case if you have

enable this feature then you can the option of Account Invoice mode for

recording any invoice or else you need to record your sales or purchase in

voucher more i.e debit and credit mode.

15)

Use Debit and

Credit Notes :- To record

any sales or purchase return debit note and credit note voucher type need to be

use but in default Tally configuration Debit and Credit Note button will not be

highlighted for recording any transaction. It will be available only after

enabling this option.

16)

Record

Credit/Debit Notes in Invoice Mode:- You can record credit or debit note in invoice mode

if you have enable these option or else you can record the same in voucher mode

i.e. Debit and Credit Mote (To and By mode)

Budget and Scenario Management

17)

Maintain

Budget and Control :- Tally have budget control feature as well which help you

to estimate your cost or revenue with budheted and actual figure. Many of us

are not aware of this feature but this strong tool may help management to make

appropriate decision.

18)

Use

Reversing Journal and Optional Voucher :- Reversing journal is an important

tool to make any scenario. Scenario is kind of creation of situation with

multiple alternatives which is hardly know by anyone. Optional voucher is help

you to book any voucher or invoice without affecting books of accounts. It is

kind of approval base or demo entry.

Banking Feature

19)

Enable Cheque Printing

:- Generally we have

tendency to prepare cheque manually but this feature helps you to print the

cheque details on command instead of writing manually. List of banks and their

cheque format are pre defined in Tally and you can easily configure your cheque

for print.

20)

Set\Alter

Transaction Type :-

Transaction Type mean nature of banking transaction that may be NEFT/RTGS,

cheque, Online E-Transfer etc

21)

Set/Alter

Banking Feature :- This

feature help you to update Bank Account details of your party master on click.

You can directly import Excel file to update bank details in Tally. (Check out

my video on you tube)

22)

Set\Alter Post

Dated Transaction :-

This feature help you to tag any payment or receipt banking transaction as post

dated which help you to get the information of cheque issue or received for

near future date.

Other Feature

23)

Enable Zero

Valued Transactions :-

This option will help you to record any transaction with Zero Value. Example

Sample Goods Supply. Issue of Blank Cheques etc.

24)

Maintain

Multiple Mailing Details (Company and Party Masters) :- It is one of important feature of Tally which serve

one of important purpose of multiple address. There may be case where Company

have different branches in same state or different states. This feature will

help you to put multiple address of company. Similarly your buyer and supplier

may have different address with different GSTIN then you don’t have to create a

new ledger. You can easily use this feature to maintain multiple address of

same ledger.

25)

Enable Company

Logo :- Your company logo

can be configured to print on invoice. Logo will be printed on few vouchers

only which are termed as outward document e.g. Sales Invoice, Payment Voucher.

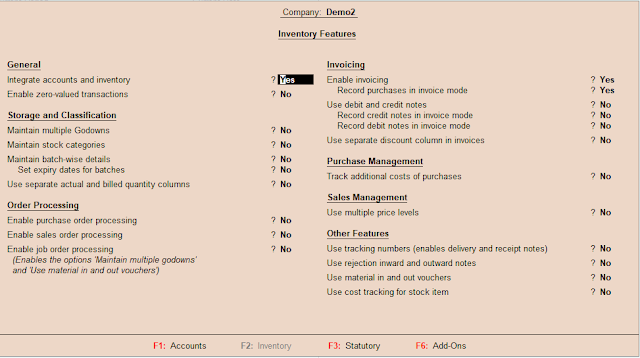

B) Inventory

Feature :- This include

all feature related to stock management.

26)

Integrate

Accounts with Inventory :- Refer Point (ii) in Accounting Feature.

27)

Enable

Zero Value Transactions :- Refer Point (xxiii) in Accounting Feature.

Storage and

Classification

28)

Maintain

Multiple Godown or Locations :- This

feature help you to store your stock in different type of godown or locations.

Location and Godowns are not same. Godown may be location but location may not

be godown. Location is place where there may be multiple godown or store house.

Godown type may be Our stock godown, our stock with third party or third party

stock with us. (To get complete details share your query in comment box)

29)

Maintain Stock

Category :- Stock

category refers to segregation of stock

according to business nature such as electronic goods, Household goods etc.

30)

Maintaining Multiple Batches and Set Expiry Dates :- This is important feature for such stock items which

are perishable in nature. It means having expiry dates. Example Medicines are

manufacture with batch or lot number with expiry date. This feature help you to

move out your stock basis on expiry of product.

31)

Use Separate

Actual and Billed Quantity Columns :- Actual and

Billed Quantity is the concept generally used for sales promotion. In such case

supply of goods quantity is different then billed quantity. Example buy one get

on free in this case goods has been given 2 Pcs where bill is charged for one

only.

Order

Processing

32)

Enable Purchase

Order Cycle:- Purchase

order cycle is completely a different feature which enable the option of

following complete purchase order cycle. Example giving purchase order to

supplier>> Receipt of Goods against Purchase Order >> Rejection of

Goods >> Recording Purchase Invoice >> Purchase Return.

33)

Enable Sales

Order Cycle :- It

is similar to Purchase order cycle as Receiving Sales Order >>

Dispatching Goods against Sales Order >> Rejection In >> Sales

Invoice >> Sales Return.

34)

Enable Job

Order Processing :-

Job order processing refers to outsourcing the job either Job work in or Job

work out. In case if you have some semi finished goods which you outsourced to assemble

into finished goods against job charges. Complete Job Work In and Job Work Out

Order can be maintained with this feature of Tally.

(Order Processing Management in Tally can be explained detailed if

needed)

Invoicing

35)

Enable

Invoicing :- Refer Point

_____ in Accounting Feature.

36)

Use

Debit/Credit Note (Invoice Mode):- Refer Point _____ in Accounting Feature.

37)

Use Separate

Discount Columns :-

In case if you wish to provide discount against rate of each item then this

feature help you to get separate column on Invoice for discount.

38)

Track

Additional Cost of Purchase :- When company want to load the sundry charges value on stock cost then

this feature can be used. Example loading charges can be added to cost of

purchase.

39)

Use Multiple

Price Levels :- This feature

help you to set multiple price level for same item for different type of buyer.

Example a product may be sold higher price to non regular buyer as compared to

regular buyer. Classification of price level can be done according to nature of

buyer.

Other Feature

40)

Use Tracking

Numbers:- This feature

helps to track down delivery or receipt of goods against sales and purchase

order.

41)

Use

Rejection In and Out :- Goods can be rejected and sent out or received in

against delivery or receipt of goods. Goods delivered to buyer be sent back

buyer due to damage then such cases goods can be treated as Rejection in.

42)

Material In and

Material Out :- This feature

support the feature of Job Order Cycle to send or receive goods against Job

work in or Job Work out order.

43)

Use Cost

Tracking :- This feature

help you to get estimation of cost and can be tracked down sales purchase to

get profitability for stock.

C) Statutory

and Taxation :- This help you to enable applicable taxes in

organization.

44)

Enable GST :- In case if you are registered under GST you need to

enable the option and along with that you need to configure all GST detail such

as GSTIN, state, registration type etc.

45)

Enable VAT :- VAT has been replaced by GST but still in some cases

it is applicable such as Petrol, stamp duty etc.

46)

Use Excise :- This was related to manufacturing and dealing of

stock. It has been now replaced by GST.

47)

Enable Service

Tax:- Service Tax has

been replaces by GST.

48)

Enable TDS :- TDS is still applicable and Tax deduction on payment

and expenses can be deducted under several nature of payment. This can be

manged and filed 24Q and 26Q via this option of Tally.

49)

Enable TCS:- This is similar to TDS feature where TCS collected on

sales invoice.

Apart from Accounting, Inventory & Taxation Feature there are

several more feature as Audit Feature, Add on Feature and other configuration

feature. Those are others feature hence not covered under this article. In case

if it is needed then can be explained in another article.

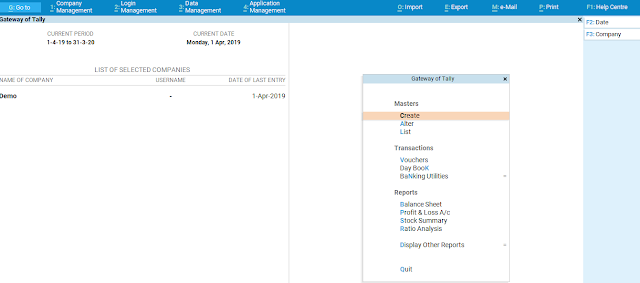

I hope guys you have understand the each feature of Tally. One Important

thing to update that F11 Feature under Updated Version of Tally18 OR Tally

Prime is going to change look at below image of updated Tally (Going to be

launch soon)

Have a look at New Look of Gateway of Tally under Tally Prime (New Version Tally18)

So guys don't foregwet to share your feedback on gstintally786@gmail.com or whatsapp 9699333653

Regards,

Parvez Ansari

GST AND TALLY WALA

1 Comments

Really cool post, highly informative and professionally written and I am glad to be a visitor of this perfect blog, thank you for this rare info!

ReplyDeleteBest Quoting Software